The Golden Age of WealthTech

WealthTech tools are already disrupting the almost 100-year-old Wealth Management industry!

Robo-advisors, automated investments, and digital trading — new WealthTech tools are already disrupting the almost 100-year-old Wealth Management industry and we can undoubtedly look forward to continued innovation! I’m most enthusiastic about higher service standards for this industry through more personalized advice, increased trust between the client and advisor, and digital tools. The romanticized dream of the future of Wealth Management is best encapsulated as the “Waymo of Wealth Management” — smart and on-demand. Imagine a world where the entire wealth management function will be largely automated, and you as the client may only need to see a wealth advisor once in a blue moon. Wouldn’t it be great to access beautiful and digestible dashboards on your phone or iPad that outline your entire financial situation? Eventually, once your investment goals are set up, funds will be automatically invested, your retirement will be planned, and portfolio allocation will be adjusted seamlessly. You’ll also be able to speak to a highly competent robo-advisor, on-demand, just like calling an Uber. And if need be, a human wealth advisor will be available to answer any questions about the increasingly complex investment landscape. Your advisor will be equipped with all your data points and will understand the personal details of your financial goals even though you haven’t spoken in years!

Borrowing the adage from Bill Gates¹, I expect significant improvements in WealthTech over the next ten years, but I expect disappointment in the next two. For instance, Robo-advisors haven’t entirely disrupted the industry just yet. Wealth Management was once considered a service that was only accessible to the affluent, and robo-advisors were supposed to open the gates to quality financial advice for ordinary investors, regardless of net worth. However, robo-advisors failed to engender trust, found difficulty scaling in different geographic jurisdictions, all while the cost of customer acquisition remained elevated. HOWEVER, technology DID disrupt the Wealth Management industry in a different way… developments in the industry have a) reduced costs required to service investments, chipping away at fees charged to end-clients, and b) improved efficiency of advisors by freeing up more time to spend with clients. I believe the future of WealthTech is bright, and entrepreneurs are building solutions for the next generation of wealth clients. Ring in the Golden Age of WealthTech!

“Two years ago, the notion that a wealth management business could take on a new client and provide appropriate financial advice, all without meeting that person, was unheard of. Now it’s the norm,” says Finn Houlihan, MD and chartered financial planner at wealth management firm Arlo Group UK. “That’s thanks to some incredible strides by compliance departments and also to important investments by firms in ensuring that their teams have the right digital infrastructure to engage with their clients remotely.”²

What is WealthTech?

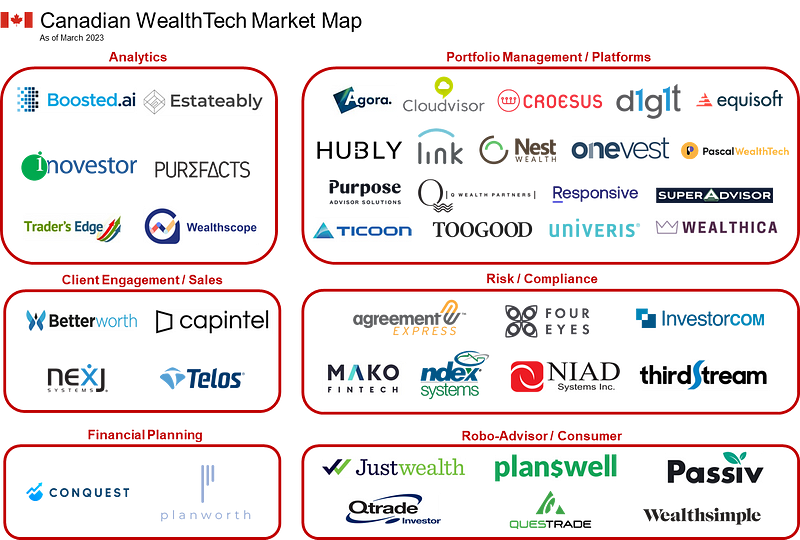

Let’s back it up and dig into what WealthTech is, exactly. Wealth Management is a behemoth industry that largely hides in plain sight. Almost everyone with an investment account is a customer in this space. Wealth Management is an investment advisory service provided by advisors to help clients preserve and protect wealth. It covers services such as investments, tax planning, and estate planning. WealthTech falls under FinTech, but specifically focuses on digital solutions that facilitate the process of Wealth Management such as prospecting, sales, advice, portfolio construction, compliance, and risk management. WealthTech companies are already providing new channels to deliver more efficient, and cost-effective services to end-clients.

Trends Driving the WealthTech Transformation

Many of the mega trends that are driving WealthTech growth have been around for decades. With that said, I believe they will drive significant progress in the next few years because of fast-evolving consumer needs (accelerated by the COVID-19 pandemic) and a focus on profitability as AUM declines (due to the stock market correction). I find these secular tailwinds compelling and I believe these trends will open doors for WealthTechs serving the broader Wealth Management industry.

“The Great Wealth Transfer”

Baby Boomers in North America are expected to pass on an estimated ~$30T of wealth to their children³. The Baby Boomer generation currently holds 50% of all wealth in Canada, while Millennials only hold 8%, leading to a large generational wealth gap⁴. The difference in generations is even bigger in the US⁵. When the Baby Boomers pass on their wealth, there will be turnover of many advisor-client relationships. The Wealth Management industry currently relies on deep relationships, and trust built over time. On the other hand, Millennials and Gen X, who are more tech savvy, prefer digital tools and aren’t afraid to change advisors if they aren’t satisfied⁶. The seismic shift in client demographics leads to this next megatrend.

“Radically Different Client Service Expectations”

Simply put, the next generation of clients expect a) digital & hybrid formats for wealth management and b) custom-tailored solutions⁷.

a) Clients will still want deep relationships, including frequent & empathetic engagements with their advisors. However, these clients also expect “Silicon Valley” style dashboards as table stakes⁸. In other words, customers demand the same seamless digital experience offered by the likes of Amazon, Apple, and Uber. Wealth Managers will need to leverage WealthTech to deliver a new age of client experience through digital interfaces, automatically generated dashboards, and mobile solutions.

b) About 64% of millennial investors and 51% of those aged 35 to 54 said they are willing to pay more for individualized investment products and services⁹. This is unsurprising as a common criticism toward financial institutions is that they don’t really understand their clients. The ability to leverage client data will help wealth managers generate personalized insights, or at least the guise of tailored solutions. For example, goal-based investing (GBI) is one method advisors are beginning to leverage as a bespoke offering. Thanks to recent advancements in the investment industry, most independent advisors and wealth managers now have equal access to the same investment products, modelling tools and services. The commoditization of investment advice, at least for the mass affluent, has diluted the value proposition for the average advisor. Thus, it is estimated that in the next 10 years, 80% of advisers will offer goal-based advice to enhance their value proposition as GBI needs to be custom-tailored¹⁰. The investment landscape is becoming increasingly complex, and clients often have multiple conflicting goals. One possible outcome is that the measuring stick of success (and thus commissions for advisors) will be based on beating client goals rather than return benchmarks. Advisors of the future will need to utilize new WealthTech solutions to access customer data, portfolio analytics tools, and new-age financial planning software — all with the ultimate goal to deliver deep insights (and value) to clients.

“Beating The Squeeze”

Wealth Management compared to other business lines in a bank, has lower capital requirements, higher growth prospects, higher ROE, and greater stability of income. The segment is clearly attractive — just look at banks such as UBS, Morgan Stanley, and RBC and their relentless focus on the Wealth Management segment of the business compared to other segments like retail and investment banking¹¹. However, wealth managers are feeling pressure on both sides of the P&L as fees are dwindling and costs are creeping.

Several secular trends impact the top line of wealth managers such as a) a shift to passive investment strategies, and b) the do-it-yourself (DIY) investing era. Starting with a), investment funds have been shifting from active investment strategies to passive strategies. Passive investing is predicated partly on the notion popularized in academia a generation ago that costs associated with active stock-picking can erode long-term returns. The long-term underperformance of active managers is staggering as 84% of large caps underperform benchmarks after 5 years¹². More self-directed retail investors and sophisticated institutions alike are turning to lower cost, passive vehicles which is eroding the fee base of wealth managers¹³. Next on b), thanks to the democratization of investing knowledge and information, clients have heightened buying power. From 2015 to 2019, the asset-weighted average management fees for institutional mutual fund shares have declined from 49 basis points to 45 basis points¹⁴. It’s never been easier to pick up DIY investing than right now! Wealth managers are finding it harder and harder to justify fees when investment advice is intermediated and commoditized.

On the cost side, wealth manager expenses are steadily rising due to a) increasing regulatory costs, and b) technology debt. Starting with a), rising compliance expenses pose new challenges to wealth managers. Advisors have always had to run adequate KYC/AML to onboard new clients, check suitability standards and diligence fund managers. However, regulation in some countries cut down on commission revenues, while the need for heavier compliance created significant costs for advisors¹⁵. The new requirements by industry watchdogs increase the operational burdens on wealth managers, however leaders can equip themselves with technology solutions that automate repetitive compliance work. Next on b), most wealth managers have struggled to deploy new technologies and have lagged behind other consumer-facing industries, playing catch up to rising expectations¹⁶. Due to years of technology underinvestment, firms remain saddled with tech debt, manually intensive processes, and complex servicing arrangements, leading to stubbornly high operating costs¹⁷. According to a recent study, while some technology verticals such as CRMs, and financial planning software have high adoption rates, there are still several “pen and paper” processes¹⁸.

To profitably serve new clients tomorrow and to defend their fee pools, Wealth Management firms will need to be leaner than they are today. Theoretically, all facets of an advisor’s practice can be improved or streamlined with tech solutions¹⁹. WealthTech solutions can help advisors and wealth managers reduce manual work, and free up time for higher-value workstreams, such as facetime with new and existing clients.

“The Independent Advisor Revolution”

Wealth advisors were long tied to large brokerage firms and wirehouses. The last decade has seen advisors migrate to independent advisor platforms. In the US, registered independent advisor (RIAs) now accounts for 24% of all wealth advisors in 2020, compared with 16% a decade ago²⁰. Advisors in North America are going independent as they want to monetize their book of business and provide advice to their clients free of conflict. WealthTech solutions have already played a large role in this transition, as wealth management point solutions have significantly lowered the barrier for advisors to transition. Unbundling of the wealth tech stack into composable modules makes it easy for advisors to adopt best practice solutions for each function. While integrating them holistically is a challenge, cloud-based architecture allows for top-of-the-line point solutions traditionally available only at large dealers. Independent advisors‘ reliance on third-party products and point solutions creates an opportunity for participants in the WealthTech ecosystem to seek a share of this fast-growing revenue and profit pool.

The Future of WealthTech

The Wealth Management space is going through significant dislocation, and I believe there will be many compelling opportunities for WealthTechs. Up and coming startups are making wealth management more accessible for the masses, thus physical advisors will need to demonstrate their value add. Advisors are continuing to outsource the tech stack to focus on their core competencies of selling to new clients, relationship management and financial planning²¹. I believe that WealthTech is moving away from a one-solution-fits-all approach towards point solutions; this unravelling of the tech stack opens opportunities for disruptors. In addition, incumbent Wealth Management companies are highly active in acquiring or partnering with startups to keep up with technological advancements. Rather than developing technology in-house, incumbents can leapfrog competitors²². For example, UBS almost acquired robo-advisory platform Wealthfront and Morgan Stanley acquired digital trading platform E*TRADE. M&A will continue to be a popular method to keep up with changing client demands and shifting markets²³.

Thank you to my partners Mohit and Mark for feedback and debate. If you’re excited about WealthTech, we’d love to meet you. Find me on LinkedIn or Twitter.

Sources

[1] https://www.brainyquote.com/quotes/bill_gates_404193

[2] https://www.raconteur.net/technology/wealth-management-tech-trends/

[3]Accenture: “The ‘Greater’ Wealth Transfer — Capitalizing on the Intergenerational Shift in Wealth”, 2012

[4] https://www150.statcan.gc.ca/n1/daily-quotidien/200626/cg-a001-eng.htm

[5] https://www.bloomberg.com/news/articles/2020-10-08/top-50-richest-people-in-the-us-are-worth-as-much-as-poorest-165-million

[6] https://www.cnbc.com/2018/06/28/wealth-transfer-baby-boomers-estate-heir-inheritance.html

[7] https://www2.deloitte.com/ca/en/pages/financial-services/articles/strategic-initiatives-for-winning-using-wealth-tech.html

[8] https://www.mckinsey.com/industries/financial-services/our-insights/on-the-cusp-of-change-north-american-wealth-management-in-2030

[9] https://www.forbes.com/sites/aprilrudin/2022/05/12/plugging-tech-into-wealth-management/?sh=6e2d28f21a2d

[10] https://www.mckinsey.com/industries/financial-services/our-insights/on-the-cusp-of-change-north-american-wealth-management-in-2030

[11] https://www.euromoney.com/article/2b707ue6hifm6m9zbvqps/wealth/how-morgan-stanleys-big-bet-on-wealth-management-paid-off

[12] https://www.cnbc.com/2022/10/01/underperformance-is-abysmal-in-the-long-run-for-active-fund-managers.html

[13] https://www.ft.com/content/f7ca9643-ed82-4993-9aa8-9c7617b33009

[14] Cerulli: https://www.wealthprofessional.ca/investments/etfs/asset-managers-must-innovate-to-fight-fee-compression-says-cerulli/334885

[15] https://www.bain.com/insights/robo-advice-has-stalled-but-wealth-technologies-still-hold-promise/

[16] https://www.mckinsey.com/industries/financial-services/our-insights/on-the-cusp-of-change-north-american-wealth-management-in-2030

[17] https://www2.deloitte.com/ca/en/pages/financial-services/articles/strategic-initiatives-for-winning-using-wealth-tech.html

[18] https://www.kitces.com/wp-content/uploads/2022/01/The-Kitces-Report-Kitces-Research-On-Independent-AdvisorTech-Vol-1-2021-FINAL.pdf

[19] https://wealthtender.com/advisors/wealthtech/what-is-wealthtech/

[20] https://www.mckinsey.com/industries/financial-services/our-insights/us-wealth-management-a-growth-agenda-for-the-coming-decade

[21] William Blair Wealth Tech (July 25, 2022)

[22] https://www.bain.com/insights/how-up-and-coming-investors-are-upending-the-wealth-management-business/

[23] https://www.cbinsights.com/research/wealth-tech-startups-funding/