Future of Private Market Secondaries

The future of private markets, how Carta tried to enter the space, and what are the powerful tailwinds shaping the industry.

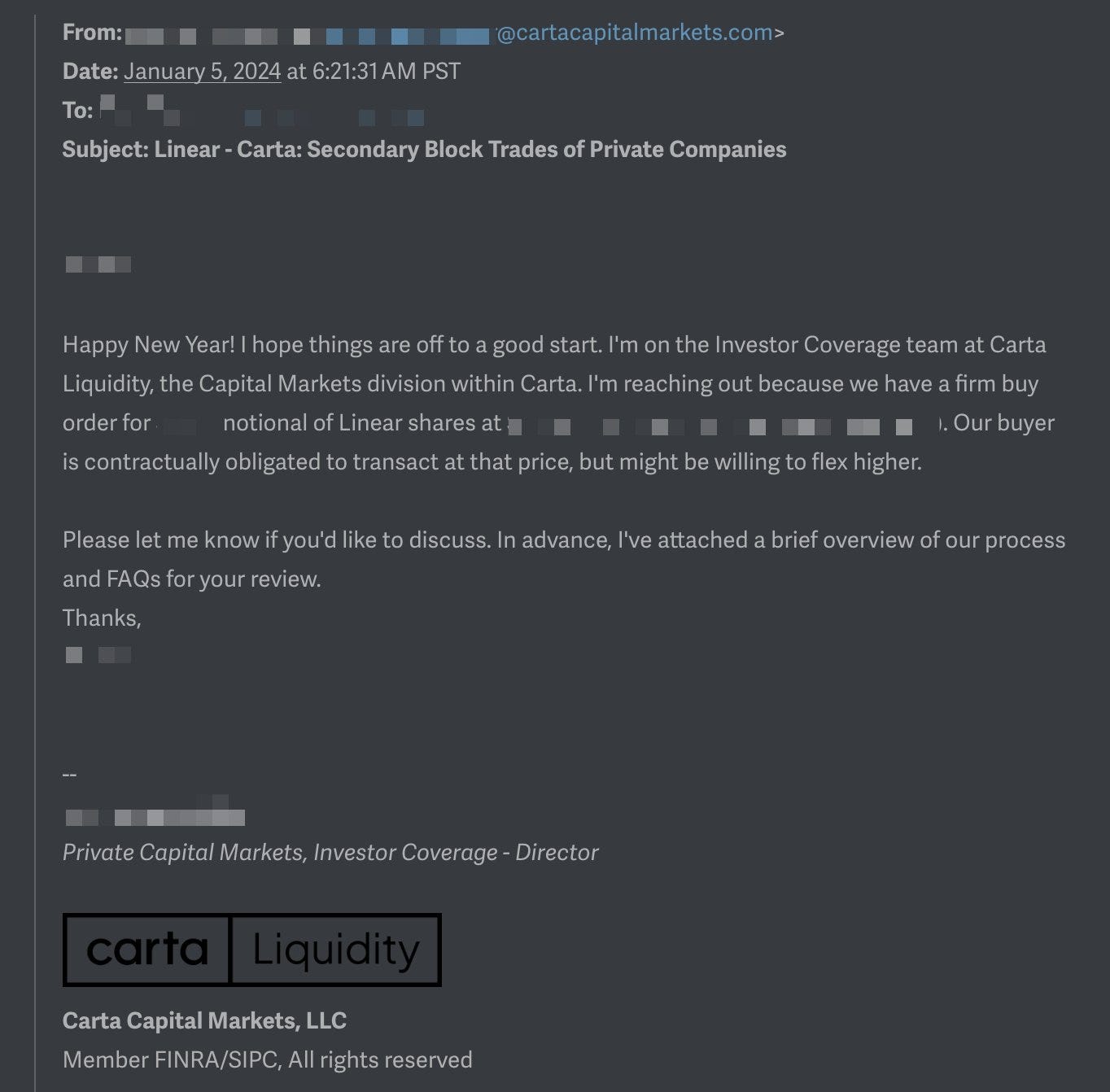

The story of the private secondary market for companies needs to start with the notorious story of Carta. Carta, as you probably know is a primarily a cap table management software. The company has access to highly sensitive private company shareholding data. In January of 2024, news broke that a Carta employee has been using their client’s confidential shareholdings data, to profit for their secondary business. This incident sparked outrage. In a subsequent post written by the CEO of Carta months after the incident, Henry Ward posits that no one can build a secondary marketplace. However, I believe that Carta specifically can’t build a secondary business because of the classic “Agency Problem”. Carta’s situation is akin to your accountant peddling your company’s private data to outside investors for a fee1. This is a conflict of interest!

(Carta employee using cap table information to encourage shareholders to sell)

Carta did the right thing and immediately shut down their secondary business. However, it signaled to me that the private secondary shares market is highly compelling if Carta was willing to risk their main cap table business (and spend $150MM) building the secondary business. Interesting! Consider that Carta has a $7.4Bn valuation on ~$370MM SaaS topline in the cap table management software business. The entire cap table management space as estimated to be worth $500MM-$1Bn in top line, which means there’s still runway for growth. If you apply a generous 15x multiple on $370MM of SaaS, it implies a $5.5Bn valuation on the business. This means that there is a billion-dollar+ valuation gap that was previously attributed to Carta’s secondary business. I came to the same conclusion as Matthew Prince, the CEO of Cloudflare, who also pointed out that Carta NEEDS the secondary business to grow into their valuation. I believe there are a few highly compelling tailwinds that are going to revolutionize the private secondary market.

What is Private Market Secondaries?

There are two primary drivers of secondary sellers. A) Employees at startups are often granted stock, instead of cash compensation. As employees depart or want to start families, they are highly motivated to sell. However, these shares take a long time to vest, and are illiquid. B) Angel investors tend to be early backers in the company, and typically by year 5 would like their money back (or at least a part of it). Private market secondary transactions allow these individuals or organizations to sell shares to outside investors.

The process to facilitate trades in the private market is cumbersome. The traditional secondary market is opaque, inefficient, and highly manual. It typically involves a broker that negotiates the number of shares, and the price with interested buyers on an episodic basis. Buyers often have no information, access to management nor disclosures on the most basic financial metrics. Both sides operate in the dark. It is also a pain for the founders, as the company typically must administer the transaction and play the role of the herder. Every company is also different as they have a different set of legal approvals, and consent rights (i.e. ROFOs).

Trends Driving the Private Market Secondary Transformation

Problems often present as opportunities for the innovator, and I believe there is a bright future ahead for this industry. Two mega trends are driving this change.

Companies Are Staying Private

Companies take a longer time to IPO and are staying private for a variety of reasons (which we will explore below). There has been a steady increase in age of tech IPOs from ~7 years in 2000 to ~12 in 2020.

The down-market effect is that there are simply more private unicorns today than a decade ago. There were approximately ~170 private unicorns in 2015, and there are now a whopping ~1,400 in 2024. Not only are there more private tech companies, they are more valuable. The median market capitalization of companies at the time they IPO has also increased from $493 million to $4.3 billion between 1999 to 2020.

Why is this happening? Many entrepreneurs don’t want to deal with the day to day challenges of managing a public company. With the availability of late stage capital as well, founders are happy to create more value while private. This allows high growth companies to focus on longer term strategic growth.

The opportunity cost of not investing in late stage private tech is so high that some traditional public markets investors, have become “crossover” investors, striking deals with late stage private companies. Traditionally known as hedge funds, these investors realized that the companies they would’ve invested via the public markets a decade ago are now staying private. In addition, these private companies are creating significant value before they go public, which means there’s less upside post IPO. Crossover activity represented 36% of venture capital investments in 2020 and represents a 58% increase year over year. It makes perfect sense to me why the crossover funds would expand their scope when the opportunity is so compelling down-market. These are one of the many players that are actively buying secondary stakes.

Desire for Liquidity

As more shares stay private, all stakeholders (i.e. investors or employees) eventually would like monetization. The typical hold period for a VC is 7-10 years, which means that most early-stage investors need an exit before the company goes public or is bought out. On the other hand, big tech employees have even shorter holds as the average tenure is now 1-3 years. Both parties may not have the luxury of timing their exit to a significant funding round and in some cases needs a monetization event earlier. Sellers will need a liquidity event, and we know from the above that buyers are highly interested as well. This creates a marketplace.

Future of Private Market Secondaries

I believe that technology can reduce the friction in the private secondary market. Given the tailwinds described above, there is significant supply and demand for the shares, however, the current market is plagued by opacity and inefficiencies. There are already several digital platforms that facilitates private market transactions, making the process more seamless, transparent, and functional. Ultimately, these platforms aim to deliver a public trading experience for the private markets (aka the Robinhood for private shares). The winning platform will need pricing information, transaction history, and most important of all, listings.

In the near term I expect that the majority of transactions will still go through traditional broker dealers on a one-off basis (or via tender offer). However, these new disruptive platforms have the potential to capture more share. I’ve included a market map of the major players I will be tracking below. Find me on LinkedIn.

.

I understand that Carta’s cap table business was separate from their secondary business. However, when two conflicting businesses operate under the same company, it erodes the trust of the customer base.