The Renaissance of PropTech: Why Now is the Moment for Real Estate Innovation

How Real Estate Vertical Software Creates The Coveted Winner-Take-All Dynamic

The Greatest Economic Moat

From an investing perspective, I've always been interested in vertical software or industry specific solutions for two reasons. 1) I've found that these companies tend to deliver a more customized product for the end user than the horizontal ones. For example, in the private investment industry, I've personally found that Affinity’s CRM is a much more tailored and thus more useful vertical software solution, as compared to Salesforce which is the horizontal incumbent. 2) In addition to better products, the vertical software industry lends it self to a winner-takes-all dynamic that creates quasi-monopolies. These solutions often become the industry standard, and are adopted as executives shuffle around other companies in the same industry. For example, after a CFO departs their current organization to a smaller company, they often push for NetSuite implementation to replace QuickBooks since it is the “gold standard”. These dynamics in industry specific solutions create a strong compelling economic moat.

This line of thinking led to an interest in the real estate industry. It is the world’s largest asset class and it is undergoing a massive transformative renaissance. The global real estate asset value reached a staggering $327 Trillion in 20201. However, despite its outsized economic influence, real estate remains one of the most antiquated and analog industries, plagued by inefficiencies tied to paper trails, manual processes, and tribal knowledge2. Yet, as other sectors raced ahead in adopting technology, real estate lagged, leaving immense opportunity for innovation. Enter PropTech—Property Technology—the vanguard of digital innovation poised to modernize this traditional sector. PropTech’s promise lies in digitizing processes, enhancing efficiency, and creating value for stakeholders across the board. From automated property valuations to predictive maintenance systems, new technologies are not just streamlining operations but redefining what’s possible in construction, commercial, multi-residential, and beyond.

This article dives into why the PropTech industry is attracting entrepreneurs, explores the macroeconomic and societal tailwinds propelling it forward, and maps out the key areas where I’m focused on.

Why is Now the Right Time?

A confluence of forces has made this moment uniquely ripe for PropTech’s ascension:

Technological Innovation: Advances in AI, IoT, and blockchain are creating tools to solve problems that were impossible a decade ago. Hardware costs for IoT sensors have down by 66%3. It is now much more affordable to outfit multiple sensors to a room in a commercial office building as devices are <$2 each. Internet infrastructure has improved drastically as well. 5G infrastructure can now handle 1MM devices per square kilometer, whereas 4G could only handle 100k (10x increase!)4. There are also significant improvements in speed and latency as well (see table below). These internet connected IoT devices has enabled new use cases, and probably dozens more that entrepreneurs are currently building for.

The COVID-19 Effect: The pandemic fundamentally shifted perceptions of space and its utilization. Remote work, hybrid offices, and changing consumer behaviors flipped the industry upside down. On one hand, office vacancy rates during the pandemic shot up from 2% to 18% in Canada and property owners were left reeling5. On the other hand, the pandemic lit a fire under the real estate industry and ignited rapid adoption of technology. During the pandemic, property owners turned to digital tools for tours, signatures, contactless access, payments, and tenant portals. More importantly, it fundamentally altered the mindset of the property owners6. The industry woke up and are shifting away from a “reactive” approach to technology, to a much more strategic view.

Tailwinds Shaping the Industry

Several macro trends are powering PropTech’s momentum:

Energy Transition and Decarbonization: Sustainability is no longer a buzzword—it’s a mandate. PropTech companies focusing on energy efficiency and carbon reduction are becoming indispensable as the industry seeks to meet stringent environmental targets. For instance, Local Law 97 in New York will have penalties for buildings exceeding emission limits. This is catalyzing property owners to A) track their emissions, and B) find ways to comply with emission standards7. We recently invested in Kode Labs who is helping their customers tackle both A) and B). In addition to regulatory compliance, real estate owners have extra incentive to invest in efficient buildings, as both property buyers and tenants are willing to pay premiums for properties with stronger sustainability profiles8 (premium of 6% on rent9). In addition, tenants are more willing to commit to longer leases, as research indicates well-rated properties (on sustainability) secure contracts that are around 3 years longer than their less-sustainable counterparts10.

Housing Affordability: Rising home prices and the demand for more accessible housing solutions create opportunities for tech-driven affordability innovations, such as modular/pre-fab homes and alternative financing models. There’s also significant government support. For example, the US Housing Supply Action Plan is facilitating nearly $20 billion for housing projects11. I personally anticipate substantial public sector support in the future, driven by strong societal backing.

Urban Population Growth: By 2050, 66% of the world population will live in urban centers, up from 54% in 201512. The number of megacities (cities with populations exceeding 10MM) is projected to rise from 31 in 2020, to 43 by 203013. As urban centers expand, cities face increasing pressures on infrastructure, housing, and traffic. Smart city solutions and tech-enabled urban planning are crucial to meeting these challenges. For example, we invested in Miovision - an intelligent traffic solutions company for cities.

Interest Rate Relief: Lower rates = lower cost of capital, which ultimately encourages more property development, and real estate activity. Rates are expected to come down, but this is a double edged sword as the real estate industry is constantly fluctuating between boom-bust cycle.

Tenant Experience: similar to sustainability, tenant experience is now tables takes. Simply put, happy tenants = low vacancy rates. This is creating opportunities for community engagement front ends, and social platforms. As an extension of tenant experience, all stakeholders (developers, brokers, owners, operators) want the “Netflix” of PropTech14. The next generation of users have high service standards, and expect “Silicon Valley” style dashboards15. In other words, customers demand the same seamless digital experience offered by the likes of Amazon, Apple, and Uber via digital interfaces, automatically generated dashboards, real-time data, read/write functionality and mobile solutions16. This is a common theme I’ve seen and written about in the FinTech side as well.

Headwinds Shaping the Industry

Despite the positive trends, there are some headwinds to consider.

Multiple Customer Personas: selling a PropTech is no easy feat. There are various buyer personas and a plethora of white tape17. Property managers are focused on operational ease and functionality. These are the likely users of PropTech but are often not the decision makers. Property owners typically have authority but are focused on ROI, cap rate, and asset value. Add in the facilities manager, developer, tenants and builders to further complicate the process. The selling motion also involves multiple departments, long procurement cycles, and requires several decision makers. On the corollary, once a technology is implemented, it is difficult to replace.

Resistance to Change: property owners, REITs, and private equity are in tune with digitization, however, I believe the process will be slower than expected. The reality is that the market is highly fragmented, and change will take time. Real estate still lags behind other industries in technology adoption18.

Data Silos: many start-ups need access to building data as part of their value proposition19. An emissions dashboard is useless unless it can tap into the right data sources. Real estate technology is notoriously poorly integrated as they use a fragmented bucket of softwares20.

Scarred By Overpromise: Historically, the PropTech industry is marred by overhyped innovations that never delivered21. Buyer’s are initially skeptical (and rightfully so). A quick search yielded a few notable results: iBuying, LATCH, and of course WeWork22. Buyers will be highly focused on tangible ROI, and time to value.

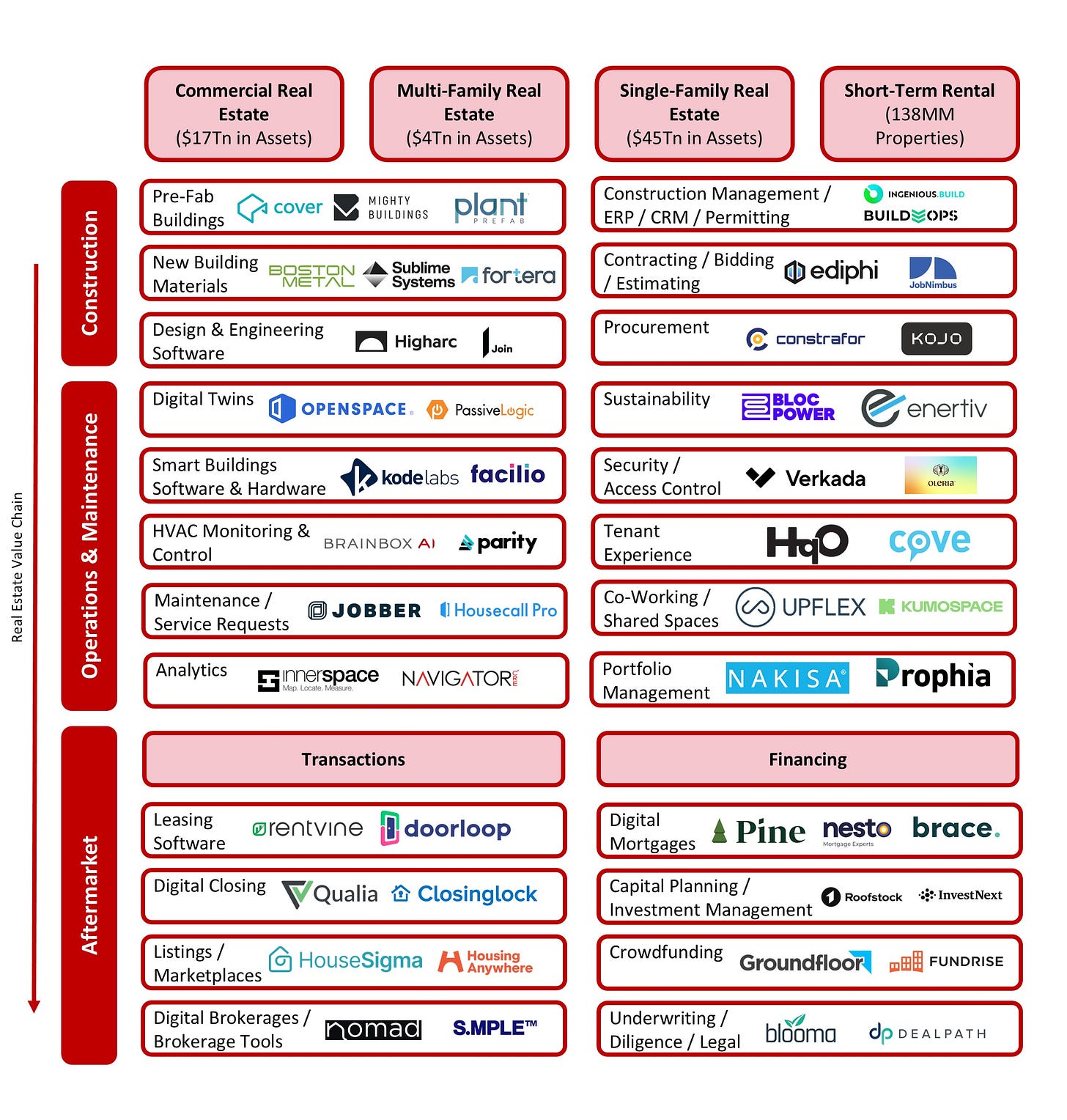

Mapping the Market

PropTech is a broad church, encompassing numerous verticals and players. According to Ascendix, there are 10,000 PropTech companies23. The map is demarcated by value chain, end-market, and function. In future posts, I will dive into these subsectors in more detail.

Conclusion

PropTech isn’t just about technology; it’s about solving real-world problems in one of the most critical industries to the global economy. With its vast potential for disruption, alignment with sustainability goals, and ability to enhance tenant experiences, PropTech is poised to be one of the most exciting investment areas of the decade. As the industry evolves, the real question isn’t whether PropTech will transform real estate—it’s how far it will go. And for entrepreneurs, now is the time to act.

At Maverix, we are interested in all dimensions of PropTech, from consumer to commercial and from hardware to software. If you are building in this space I’d love to hear from you. I genuinely look forward to your opinions and debate!

https://www.savills.com/impacts/market-trends/the-total-value-of-global-real-estate.html

https://www.jll.ca/en/trends-and-insights/research/global-real-estate-technology-survey

https://info.microsoft.com/rs/157-GQE-382/images/EN-US-CNTNT-Report-2019-Manufacturing-Trends.pdf

https://www.exorint.com/exor-innovation-blog/4g-vs.-5g-whats-the-difference-and-how-can-factories-benefit#:~:text=4G%20networks%20are%20capable%20of,million%20devices%20per%20square%20kilometer.

https://www.municipalworld.com/feature-story/office-vacancy-rates-rising/

https://www.rouzbehpirouz.com/covid-19-has-boosted-proptech-platforms-to-create-new-solutions-for-commercial-property-sector/

https://cooperatornews.com/article/local-law-97-deadline-is-coming

https://institutional.fidelity.ca/fci/en/insights/insights-library/real-estate-leads-energy-transition/

https://www.fidelityinternational.com/editorial/article/buildings-that-go-green-making-an-impact-while-still-making-alpha-07b230-en5/

Fidelity International, Knight Frank Research, DLUHC, June 2023

https://www.whitehouse.gov/briefing-room/statements-releases/2024/08/13/fact-sheet-biden-harris-administration-takes-new-actions-to-lower-housing-costs-by-cutting-red-tape-to-build-more-housing/#:~:text=As%20part%20of%20the%20Housing,tens%20of%20thousands%20of%20units%3B

https://www.urbanet.info/world-urban-population/

https://www.un.org/fr/desa/around-25-billion-more-people-will-be-living-cities-2050-projects-new-un-report

https://www.jll.ca/en/trends-and-insights/research/global-real-estate-technology-survey

https://layer10.com/2024/08/proptech-reshaping-tenant-experiences-commercial-real-estate/

https://blog.mipimworld.com/innovation/matching-expectations-proptech-and-its-impact-on-end-users/

https://mhmod.io/overcoming-sales-challenges-in-the-proptech-industry/

https://assets.ey.com/content/dam/ey-sites/ey-com/en_us/topics/real-estate-hospitality-and-construction/ey-tech-adoption-in-commercial-real-estate.pdf

https://www.synatic.com/blog/the-future-of-proptech-is-integration-and-automation

https://www.scriptstring.com/2024/06/13/overcoming-data-silos-for-sustainable-real-estate-with-ai/

https://techcrunch.com/2024/01/08/another-proptech-startup-crashes-and-burns-citing-current-interest-rate-environment/

https://ascendixtech.com/proptech-market-map/